Travelex Money Card Review: Safety, ATM Fees, Usability, and Monito's Verdict

Jarrod Suda

Guide

A writer and editor at Monito, Jarrod is passionate about helping people apply today’s powerful finance technologies to their lives. He brings his background in international affairs and his experiences living in Japan to provide readers with comprehensive information that also acknowledges the local context.

Byron Mühlberg

Reviewer

Monito's Managing Editor, Byron has spent several years writing extensively about financial- and migration-related topics.

Links on this page, including products and brands featured on ‘Sponsored’ content, may earn us an affiliate commission. This does not affect the opinions and recommendations of our editors.

Read moreTravelex is a good travel card provider (7.8/10) peer-reviewed by the experts at Monito. Serving millions of customers across the globe, Travelex is trusted and highly credible (9.0/10) as well as very well rated by customers (9.3/10). Though it ranks highly for its convenience, the company’s Money Card offers limited and very specialized currency exchange services (7.1/10), where it offers a stress-free way for travellers to enjoy spending abroad but does not provide many of the convenient banking features that its competitors do (5.8/10).

What Monito Likes About Travelex Money Card

- Worldwide availability in airports and popular city centres.

- ATM withdrawals with no transaction fees.

- Travelex services are secure and regulated.

What Monito Dislikes About Travelex Money Card

- Travelex's exchange rates are poorer than the mid-market rate.

- Your travels may be limited by the 10 supported currencies.

- Top up fees are charged if not done through Travelex.

Spend Abroad with a Travelex Money Card

The Travelex Money Card is a reputable travel card for international spending and withdrawing cash. However, we recommend users to read Monito’s comparison guide on travel cards, which also waive ATM fees and offer even better exchange rates.

Key Questions About Travelex Money Card Answered

- 01. Is Travelex safe?

- 02. How good is the Travelex Money Card?

- 03. What are Travelex Money Card's fees and costs?

- 04. What are customers saying?

- 05. How do I open a Travelex Money Card account?

- 06. Is Travelex right for you and what are the alternatives?

- 07. Other frequently asked questions about Travelex

Last updated: 06/12/2021

⬆ Top-up | Bank transfer, debit/credit card |

|---|---|

💳 Card | Debit Mastercard |

💶 Payment Fees | 0 |

🏧 Withdrawal Fees | 0 |

💵 Conversion Fees | ~1% - 6% depending on currency |

💻 Account Details | None |

💱 Currency | 10 avaliable |

👥 Users | Approx. 4 million |

🔐 Trustpilot | 4.2/5 |

📝 Reviews | Approx. 41,000 |

Last updated: 06/12/2021

📍 Headquarters | London (UK) |

|---|---|

📃 Established | 1976 |

🖋 Licensing | Subsidiary of Travelex |

👥 Employees | Approx. 5,400 |

🌍 Available | Worldwide |

💬 Languages | 19 languages |

Last updated: 06/12/2021

Who Is the Travelex Money Card For?

Travelex is ideal for travellers looking for a safe way to spend cash abroad. Being only available to load up in ten currencies, it is particularly aimed at travellers in South East Asia or the Transatlantic region. The card includes a nice bonus to customers with free connection to all Boingo W-Fi hotspots.

Anyone over the age of 18 is eligible for a Travelex Money Card as long as they have been issued a valid government photo ID. Customers in the United Kingdom, Australia, and the 17 other countries that Travelex operates in may purchase a card and top it up online. Non-residents of these countries are still eligible but must go to a Travelex branch with their government ID to buy a Travelex Money Card.

Travelex also announced in 2021 that they have ceased operations in the United States and Canada, which includes their online services and their stores in airports and cities across the two countries. Americans and Canadians will now have to find a Travelex branch abroad to access the Travelex Money Card and its top up services.

We are trusted.

Monito's reviews are trusted by 100,000+ readers every month.

We go the extra mile.

We don't merely research. We probe and verify every statement.

We are independent.

Our recommendations are always unbiased and independent.

We are principled.

We only recommend the products and services we'd recommend to our friends and families too.

How Monito Reviewed Travelex's Services

In order to review the Travelex Money Card, we applied Monito’s rigorous methodology to score Travelex along with 20+ of its most popular competitors, including Wise (formerly TransferWise), Azimo, and WorldRemit, to see how it fared. The scoring process began with setting up a Travelex Money Card account and included thorough testing of its services both on desktop and on its mobile app. Finally, we ran a background check on Travelex, looking at how they were regulated and by which authority, and considering their security practices along with whether they had any publicly known legal, privacy, fraud, or technical issues. As with all Monito reviews, our Travelex score was peer-reviewed by at least one Monito expert.

Reviews are written independently by Monito's editors and recommendations given are our own. Services you sign up with using our links may earn us a commission. Learn more.

Trust & Credibility

Background check

In compliance with the Financial Conduct Authority (FCA) in the UK.

Security & reliability

During its data breach, Travelex complied with the Criminal Finances Act of 2017 to resolve the case.

Company size

Millions of customers worldwide and £729 million in annual revenue.

Transparent pricing

A full overview of pricing is easily accessible and provides all fees as per the regulator-standard fee schedule.

Is Travelex Safe?

Travelex is a very safe option. It is an experienced currency exchange business that has operated for more than 40 years and they are widely regulated in countries around the world, serving millions of customers a year.

However, the company was victim to a cyberattack in early 2020, compromising both customer and company data. Despite the hit to its reputation, Travelex contacted the competent authorities and filed an official investigation against the infamous Sodinokibi hacker group¹.

With their customer support up and running again, you'll be able to contact Travelex’s customer support team in any of the following ways:

- Website FAQ: The Travelex support page is nicely organized to easily answer your questions about the Money Card.

- Email: You can send an email to cardservices_prepaid@mastercard.com to send your comments or general queries about your card.

- Card Services: Travelex offers 24/7 phone support for Money Card holders. You may reach them at 0800 260 0355 if you are calling from the UK. If you are calling from other countries, please consult this list of toll-free phone numbers to get in touch.

Service & Quality

Using the mobile app

Standard and intuitive interface, although lacking an option to freeze card for emergencies.

Managing the account

Basic travel card features with no international money transfers, joint account, overdraft, or interest.

Making card payments

Contactless and online payments are supported by Mastercard, but Travelex does not support direct debits.

Contacting support

FAQ, email, and 24/7 phone support are offered but live web chatting is not supported.

Travelex Money Card's Product & Service Quality

Travelex was founded in London as a brick-and-mortar currency exchange business, which has expanded to 27 countries with over 1,500 stores. While their traditional services of cash home delivery and cash pickup continue to serve customers worldwide, Travelex’s Money Card pioneered the way for the prepaid travel card industry.

Currency Exchange, ATMs, and Benefits — How To Use the Card

With your Travelex Money Card you will be able to top up in foreign currency, which will be ready in an instant to spend on your holidays abroad. By holding the local currency in your country of travel — New Zealand dollars (NZD) in New Zealand, for example — ATMs and merchants will treat your card as any other local's card. In other words, the teller machine will never prompt you with the option of paying in foreign currency (also called a dynamic currency conversion).

The Travelex Money Card charges no ATM withdrawal fees, giving you full access to cash on your trip. Its association with Mastercard also allows you to shop online and at stores with any and all merchants who accept Mastercard. If you decide to become a Travelex Platinum member, you will even get access to exclusive discounts at participating businesses.

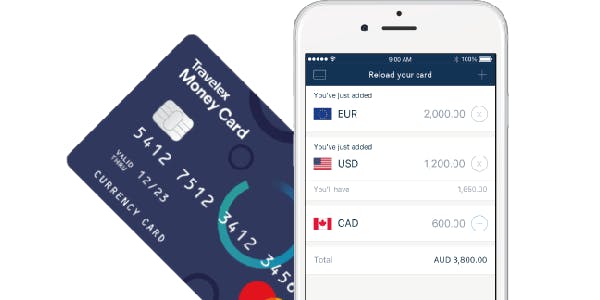

Travelex Mobile App Review

With the Travelex mobile application, users can top up their cards repeatedly, buy cash for pick up, and even transfer balances between currencies.

While the app interface is simple and intuitive, it does not provide the ability to freeze your card instantly in case of emergency. Mixed reviews on the Apple App Store as well as on the Google App Store may also suggest its functionality does not compare to other travel card providers.

The Travelex app offers you the following features, among others:

- Link your bank account details;

- Top up card in 10 currencies*;

- Transparently lock in exchange rates before purchase;

- Biometric authentication.

* UK users can get: GBP, AUD, USD, EUR, NZD, CAD, SAR, TRY, CHF, and AED.

Australian users can get: AUD, GBP, USD, EUR, NZD, CAD, JPY, THB, SGD, and HKD.

Fees & Exchange Rates

Everyday use

No monthly fees but the card lacks local transfer and direct deposit functionality.

ATM withdrawals

Travelex charges zero fees for all international ATM withdrawals.

Online spending

Transactions that require a currency conversion will be charged a 5.75% foreign exchange fee.

International spending

Travelex applies its exchange rates to your top ups in foreign currency.

How Pricey Is the Travelex Money Card?

The Travelex Money Card can be a very competitive option if customers use it only for its intended purpose: making cash transactions in the local currency of your holiday destination.

Topping Up Your Card

The first step of your holiday — topping up the card in foreign currency — is the most costly party. Travelex converts your home currency into your desired currency at their own exchange rates, which are poorer than the true rate you see on Google (called the mid-market rate). If we assume that a British traveller uses Travelex to top up £5,000 for their European travels, then Travelex would use their rates* to convert that amount into around €5,732.

Contrast that to using Wise, a London-based global money transfer service, for the same top up. With Wise's multi-currency card, you'd pay only $17.64 in service fees without an exchange rate margin. The rest of your sterling would be converted at the true mid-market rate**, topping your card up with around €5,864. This is €132 more than if you had made your conversion with Travelex.

* Conversion done at 1 GBP to 1.1464 EUR on 07/12/21 13:00:00 GMT.

**Conversion done at 1 GBP to 1.1754 EUR on 07/12/21 13:00:00 GMT.

Spending With Your Card

Now with local currency ready to spend on your holiday abroad, you can really take advantage of the Travelex Money Card features. Travelex will never charge you for either domestic or international ATM withdrawals. Although there is a 24-hour withdrawal limit of £500, there is no limit to the number of times you can visit an ATM. This is an advantage when compared to many other travel cards that do begin charging you after your third or fourth ATM withdrawal.

Spend in the Local Currency

Just be sure to use the mobile app to keep track of the amount active on your card. If you only have €30 left on your card but make a purchase of €50, then the transaction will either be declined or you will have to use the other currencies on your card until the transaction is satisfied. Failing to spend in the local currency will be costly because Travelex will automatically apply a 5.75% exchange rate margin to convert your foreign currency into local currency to complete the purchase.

Take a look at the table below to get an idea of the fees that Travelex charges:

Fee | |

Card Fee | £0.00 |

Loading Money | |

Card Payments (in local currency) | £0.00 |

Card Payments (in foreign currency) | 5.75% exchange rate applied |

ATM Withdrawal | £0.00 |

Additional Card | £5.00 |

Last updated: 25/05/2021

Spending Limits

Travelex has set some spending limits to mitigate against the case of stolen or lost cards. To freeze your current card, you will have to call up a representative. In addition, you can request a replacement card, which is free of charge and can be loaded with emergency cash up to the value that remained on the previous card.

To get a better picture of these limits in action, see the table below:

Amount loaded at any time | £5,000 |

|---|---|

Payment at merchants | £3,000 |

Bank counter withdrawal | £150 in 24 hours |

ATM withdrawal | £500 in 24 hours |

PIN attempts | 3 in 24 hours |

Last updated: 07/12/2021

The Travelex Money Card is a multi-currency card, which means that you can load up to 10 different currencies all at once. Since you will be limited to carrying £5,000 on the card at any one time, it will be important to plan how you want to divvy up the currencies — if you go on a multi-country trip.

For example, if you go on an east coast trip from Montreal, Canada to New York City, USA, then be sure to load up the right amount of Canadian dollars and US dollars accordingly. Otherwise, you will be penalized with that 5.75% exchange rate margin for spending US dollars in Canada, and vice versa.

Customer Satisfaction

Customer review score

Rating of 4.2 out of 5 stars on Trustpilot.

Number of positive reviews

Around 34,800 four- and five-star reviews on Trustpilot.

What Experiences Do Travelex Customers Report?

In general, Travelex has earned great feedback from users across the board, garnering an average rating of 4.2 out of 5 stars on Trustpilot at the time of writing.

Users frequently comment that Travelex's services are clearly detailed and easy to use. Travelex has a wide reach with brick-and-mortar counters in airports around the world, which all conveniently offer the Travelex Money Card and on-the-spot top ups to customers in a hurry.

However, current users do often complain about the mobile application that comes with your account to manage the card and your top ups. These complaints generally refer to being unable to see the account balance. Other customers have found that Travelex's exchange rate margin can be quite high.

How To Open a Travelex Money Card Account

Opening an account with Travelex and getting their travel Money Card is an easy process, which can be done online, on the phone, or at a physical Travelex counter. If you decide to open a Travelex account, you'll need to go through the following steps:

- Get your card: Order your Travelex Money Card online, over the phone or in-store. You can have it delivered to your home within around 5 days or opt to pick it up at a local branch.

- Activate your card: You will get your PIN immediately if you buy or collect your card in-store. Otherwise, you can activate the card online or on the phone by calling card services at 0800 260 0355 in the UK.

- Register your card online: Register with Travelex to manage your account and keep track of your card activity.

- Top up and spend: You can top up the card either online, over the phone, or via the Travelex Money app.

Is Travelex a Good Travel Card and What Are the Alternatives?

Overall, we at Monito consider the Travelex Money Card to be a standard travel card that may serve travellers well if they spend their holiday in countries that operate mainly in cash, such as Japan or Hungary. For these cases, we like that Travelex charges zero fees on all ATM withdrawals around the world.

The Travelex Money Card charges no fees when you make a purchase in the local currency, which beats using your traditional debit or credit card that may charge foreign transaction fees. However, there are many new multi-currency products on the market that provide this same service without the same exchange rate margins that Travelex charges.

We, therefore, recommend our readers to compare other travel card providers and assess their services and benefits before choosing Travelex. Here's how Travelex fares against N26, Revolut, and Wise:

Best Travel Money Cards for 2022 Compared — Revolut vs N26 vs Wise vs Currensea

See how to Travelex Money Card fares with other travel cards provided by innovative neobanks and digital bank-like alternatives.

|  |  |  |  | |

Top-up Method(s) | Cash, debit/credit card, bank transfer | SEPA transfer, debit/credit card | Cash¹, SEPA transfer | SEPA transfer, debit/credit card | Bank link |

Foreign currency exchange | 1-6% depdending on currency. Click to see Travelex's daily rates | 0%-2% ² | 0 | 0 | 0 |

Available Platforms | Mobile, in-store, website | Mobile | Mobile, website | Mobile, website | Mobile, website |

Account Opening | £0.00 | £0.00 | £0.00 | £0.00 | £0.00 |

Card Issuance | £0.00 | £4.99 | £6.00 | £0.00 | £0.00 |

Foreign ATM fees | £0.00 | 0% ³ | €2 + 2% ⁴ | 0% ⁵ | £0.00 ⁶ |

Card Type | Mastercard | Mastercard | Mastercard | Mastercard | Mastercard |

| Try Travelex | Try Revolut | Try N26 | Try Wise | Try Currensea |

Last updated: 07/12/2021

¹ Germany, Austria and Italy only

² On the first $6,500, up to 2.5% thereafter (Fair usage limits and Terms & Conditions apply.)

³ On the first $300 per month, 2% thereafter (Fair usage limits and Terms & Conditions apply.)

⁴ Free at Allpoint ATMs

⁵ Up to 2 withdrawals or €200 per month, then 1.75%

⁶ 2% FX rate over £500pm

Frequently Asked Questions About Travelex

Is the Travelex Money Card safe? 👌

Protected with a PIN and partnered with Mastercard, your money is safe on the Travelex Money Card. Travelex also offers 24/7 Global Travel Assistance by phone. Upon request, they can provide an emergency card and cash if your card is stolen or lost.

How do I cancel my Travelex Money Card? ❌

You will have to call up a Travelex advisor to close your account. Please reference this list of official phone numbers.

Is the Travelex Money Card a good option? 💶

The Travelex Money Card is a standard travel money card option but will serve you best if you deal primarily with ATM withdrawals and cash transactions on your holiday. Monito recommends that you compare travel cards before you make your decision.

What is the Travelex Money Card? 💳

The Travelex Money Card is a travel card product designed by Travelex, one of the world's foremost currency exchange companies in the world. The Travelex Money Card allows users to top up a debit Mastercard with up to 10 different currencies, which are instantly ready for either international ATM withdrawals or holiday spending at local merchants.

References Used in This Guide

1. The Wall Street Journal. Travelex Paid Hackers Multimillion-Dollar Ransom Before Hitting New Obstacles. 9 April 2020.

Also See These Digital Banks That Offer Travel Money Cards